iShares MSCI USA Momentum Factor Fund (MTUM)

iShares MSCI USA Momentum Factor Fund (MTUM)

Looks like a bottom is in, but need to wait for the 200 DMA to be lower than the share price.

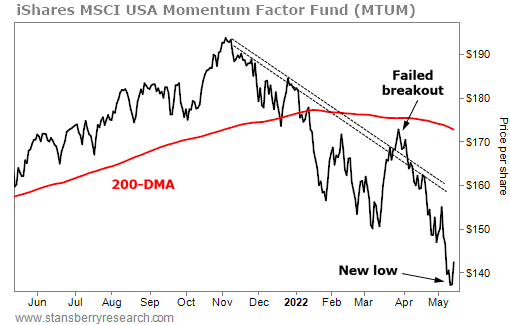

Take a look at the iShares MSCI USA Momentum Factor Fund (MTUM). This fund tracks an index of large- and mid-cap U.S. stocks that show relatively higher price momentum. Right now, it's telling me the downtrend in stocks is intact...

|

The black dashed lines from the highs mark the series of lower lows and lower highs. Yes, in late March, this fund broke the downtrend. But this was a false breakout... and really, it was a trap for bulls. After that failed rally, MTUM made a new low earlier this month.

Also note that MTUM couldn't muster up enough energy to rally above the important 200-day moving average (200-DMA) in red. This was a warning of continued weakness.

So, using trend-line analysis on this fund gave us a bearish signal. But as I often tell my subscribers, you can't just look at one market, like the S&P 500 Index, and think you have the entire technical picture figured out.

It's critical to look across many markets, indexes, and stocks to get the big picture. That's how you decide whether there's sufficient evidence that a market is topping out or bottoming.

Comments

Post a Comment